Beat the Big Banks: Custom Mortgage Tech for Independent Brokers

The big banks are winning on speed, not better rates. Learn how custom mortgage software development gives Calgary lenders the automation to fight back.

Custom Mortgage Tech for Calgary Lenders: Beating the Banks

Let’s be honest about what’s happening in the Calgary mortgage market right now.

The big banks aren't beating you because they have better customer service. They are beating you because they have fast buttons. A client can log into a bank app, click Pre-approve, and get an answer in minutes.

Meanwhile, most independent brokers and private lenders in Alberta are still running their businesses on Excel spreadsheets, email chains, and a frantic hope that the client sends the right PDF.

If your process relies on you manually typing data from a pay stub into a system, you are already losing.

- You lose speed: By the time you issue a commitment, the client has already shopped you.

- You lose trust: Asking a client to email sensitive tax documents is becoming a massive security red flag.

- You lose leverage: You are competing on rate alone, which is a race to the bottom.

To survive against the institutional giants, you don't need more staff. You need better architecture.

Is This Strategy for You?

I’m writing this specifically for:

- Calgary Mortgage Brokers who are tired of losing leads because their onboarding process takes three days.

- Private Lenders who need a secure Digital lending platform to manage risk without hiring an army of admins.

- Fintech Founders trying to build the next skip the bank tool for Canadians.

If you are looking for a $50/month CRM plugin or a WordPress template, this isn't for you. We are talking about building assets, not renting software.

The Core Problem: The Speed-to-Approval Gap

The only metric that matters right now is Speed-to-Approval. Big banks have automated this. Local lenders haven't. That is the gap we need to close.

We close it through Mortgage software development Calgary that focuses on integration, not just looking pretty.

1. Stop Manual Entry (API Integration)

If you are typing a credit score into a form, you are wasting time. We connect your platform directly to the data source.

- The Fix: We integrate the Equifax API and local CREB Data directly into your dashboard.

- The Value: You press a button, and the credit pull happens instantly. No distinct login, no copy-paste. You get the full picture in seconds, allowing you to issue a Pre-approval while the client is still on the phone.

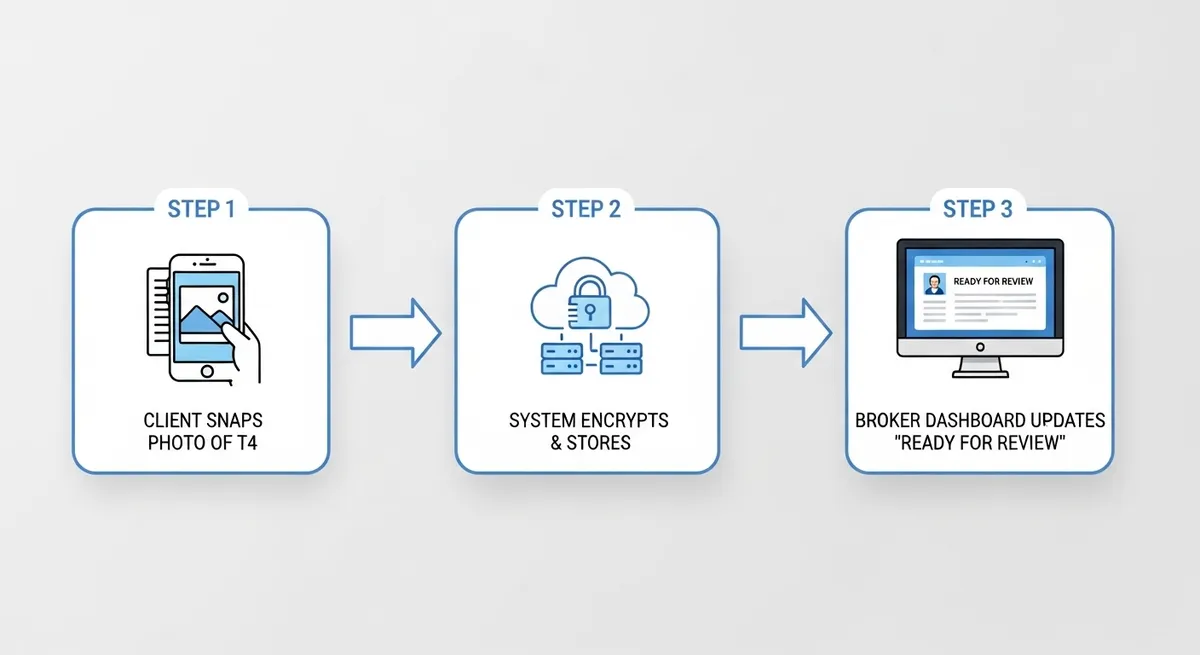

2. The "Snap and Store" Vault

Chasing clients for documents is the worst part of the job. You sent the wrong T4. I can't open this file.

- The Fix: We build secure mobile portals. The client logs in, sees a checklist, snaps a photo of their pay stub with their phone, and it automatically uploads to an encrypted server.

- The Value: Friction disappears. The app for mortgage rates becomes a document collection engine. Plus, you aren't storing sensitive financial info in your insecure Outlook inbox.

3. Let the Client Run the Numbers

Clients want control. If they have to email you to ask What if I put 20% down?, they will get annoyed.

- The Fix: We build custom Amortization and scenario calculators that actually follow Canadian stress-test rules.

- The Value: The client qualifies themselves. By the time they talk to you, they already know the numbers, saving you hours of education time.

⚠️ The Compliance Check

Are you storing SIN numbers and T4s in your email folders? In Canada, that is a ticking time bomb for liability.

👉 Request a Preliminary Tech Audit

Real World Application: The "Nuborrow" Shift

The Challenge Nuborrow saw a massive inefficiency. Homeowners wanted to access home equity, but the process was stuck in the 1990s, paper forms, slow banks, and zero transparency. They needed a way to beat the banks at their own game.

The Strategy Fantech Labs didn't just build a website. We built a lending ecosystem.

- We built a Mobile app development calgary solution that put the mortgage process in the user's pocket.

- We integrated credit score pulls so users could see why they qualified (or didn't).

- We killed the black box. The app sent real-time push notifications: "Appraisal Ordered, Underwriting Complete.

The Outcome

- ✅ Trust: The Snap and Store document feature made users feel secure.

- ✅ Speed: Automating the intake process meant Nuborrow could fund deals faster than the competition.

- ✅ Growth: The platform was built to scale, handling thousands of applications without crashing.

🚀 Ready to Build Your Own Platform?

Stop forcing your clients to use email. Give them a portal.

👉 Get a Free Architecture Audit.

The Danger of "US-Based" Software

I see this all the time in Alberta. A brokerage buys a license for a sleek US lending platform. Then they realize:

- It calculates interest differently (US compounding vs. Canadian compounding).

- It stores data in Virginia (Potential privacy violation).

- It doesn't integrate with Equifax Canada.

Using off-the-shelf software is like wearing a suit that doesn't fit. It looks okay from a distance, but it restricts your movement.

Why Fantech Labs?

We are right here in Calgary. We know the difference between a high-ratio mortgage and a conventional one. We understand the Alberta market volatility.

- We build for Canada: Our architectures are PIPEDA compliant by default.

- We build for Speed: We strip out the bloat and build workflows that get you to "Funded" faster.

- We are Partners: We don't just hand you code and leave. We help you map out the technology strategy to grow your book of business.

The Bottom Line

You can't compete with the banks on capital. They have more money. But you can compete on agility.

If you build the right Mortgage broker tools, you can offer a client experience that is faster, friendlier, and more transparent than any bank branch in the city.

Stop Chasing Paper.

Let’s automate your workflow so you can focus on closing deals.

👉 Book Your Confidential Strategy Session

FAQ

Q: Can we connect this to our current CRM (like Salesforce or HubSpot)?

A: Absolutely. That’s the power of custom development. We build a secure API bridge that pushes the client data from your new app directly into your CRM. No double entry.

Q: Is it safe to store client documents in a custom app?

A: Yes, if built correctly. We use AES-256 encryption (bank-grade). It is actually safer than your current method of letting clients email PDF attachments, which are easily intercepted.

Q: How long does it take to build a custom mortgage platform?

A: It depends on complexity. A simple intake portal can be done in weeks. A full lending system like Nuborrow takes longer. We start with an audit to give you a realistic timeline.

About the Author

Written by Talha Latif, Senior Software Engineer & Product Lead at Fantech Labs

As a Senior Software Engineer at Fantech Labs, Talha specializes in building secure Fintech ecosystems and mobile lending platforms for the Canadian market. He focuses on API integrations (Equifax/Banking), bank-grade encryption, and creating seamless digital experiences that help Calgary lenders compete with major banks.